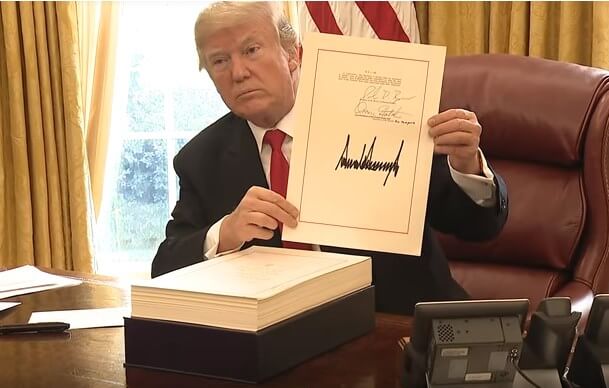

President Trump Signs Tax Bill With Solar ITC Intact

On Friday, President Donald Trump signed into law the comprehensive GOP tax reform bill, an overhaul of the federal tax code that left the U.S. solar industry largely unscathed. Congress approved the legislation along party lines earlier last week, and Trump signed the bill in the Oval Office after citing pressure from the media to meet a self-imposed Christmas deadline.

“So I’ll sign this today rather than having a very big formal ceremony in two weeks, when we were going to do it, because I didn’t want you folks to say that I wasn’t keeping my promise,” said Trump. “I am keeping my promise. I’m signing it before Christmas. I said that the bill would be on my desk before Christmas, and you are holding me literally to that, so we did a rush job today. It’s not fancy, but it’s the Oval Office. It’s the great Oval Office.”

As previously reported, the final tax legislation maintains the current phase-down schedule for the solar investment tax credit (ITC) and wind production tax credit. It also includes modifications to a new and highly complex base erosion anti-abuse tax (BEAT), but renewable energy stakeholders still have some concerns about the provision.

Before Congress signed off on the bill last week, the Solar Energy Industries Association (SEIA) praised legislators for preserving the “critical” ITC.

“SEIA appreciates the hard work of our solar champions in Congress to ensure that the tax reform bill maintains the ITC in its current form,” said Abigail Ross Hopper, the organization’s president and CEO, in a statement. “In particular, the final bill preserves the current ramp-down of the ITC through the end of 2021, maintains the 10 percent ITC for commercial developers beyond 2021, and allows the Treasury Department to issue guidance on commence-construction eligibility criteria.

“Moreover, the conference report changed the new base erosion anti-abuse tax to allow the investment tax credit to be used by solar investors,” Hopper continued. “Given the complexities of the BEAT, we look forward to working with our congressional allies to modify the provision to allow unused tax credits to be used in future tax years.”

To learn more about what the tax legislation might mean for the clean energy sector, click here.

Photo is a screen shot of a YouTube video posted by the White House

Original Source: https://solarindustrymag.com/president-trump-signs-tax-bill-with-solar-itc-intact