Feed-in Tariffs & Electricity Prices Likely To Rise In 2022. Here’s Why.

Wholesale electricity prices increased across most of Australia this financial year. Retail electricity prices should soon follow.

- If you are a Queenslander, expect a big hike in your electricity prices and solar feed-in tariff in July.

- If you live in SA or NSW expect smaller increases.

- There should be little change in Tasmania, while Victoria is set for a decrease.

A regional Queensland price hike and a Victorian solar feed-in tariff reduction have already been announced.

Compared to the previous financial year, the National Electricity Market (NEM) — every state except Western Australia — has seen the following changes in average wholesale electricity market spot prices:

- QLD up 5.3 cents per kWh

- SA up 0.9 cents per kWh

- NSW up 0.6 cents per kWh

- TAS no change

- VIC down 0.4 cents per kWh

The financial year still has three and a half months left, so this could change, especially with Russia invading Ukraine. Australian natural gas prices could rise and push up wholesale electricity prices1.

Western Australian wholesale electricity spot prices are secret. Still, their Premier has promised electricity bills will only rise at the inflation rate for the next two and a half years. I’m not expecting an increase in WA’s unfairly low solar feed-in tariff — not even to keep it in line with inflation.

I also don’t have information for the territories, but changes in the ACT are likely to be similar to NSW.

Below I’ll go over…

- Why the increase in spot prices was less than I expected for most states.

- Why spot prices aren’t the only thing that determines wholesale electricity prices.

- Why Queensland’s increase has been so high.

- Changes in other NEM states and how they may affect electricity prices and solar feed-in tariffs.

I’ll even speculate on what might happen over the next few years. But don’t rely on me getting it right because prediction is hard — especially about the future.

If you only care about what electricity prices will do in your corner of Australia – feel free to jump straight to your state or territory.

If you are interested in the whole of Australia, keep reading.

Summer Breeze & Summer Disease

Late last year, the worldwide economic recovery increased demand for Australian exports and pushed up electricity prices.

I was expecting across the board increases, but two factors prevented this:

- The COVID surge reduced economic activity.

- The summer was mild.

COVID Reduced Demand

I didn’t think COVID would get as bad as it did. I knew our leadership was incompetent, but I assumed they wouldn’t just let it rip when vaccines and public health measures were available that could have prevented most of the suffering.

In South Australia, we went from four COVID deaths in December to around 220 now. If any of the politicians responsible are reading this, I’ll mention it knocked $84 million off the state’s Christmas spending. Perhaps that news might bring a tear to your eye. The reduction in economic activity reduced the electricity demand.

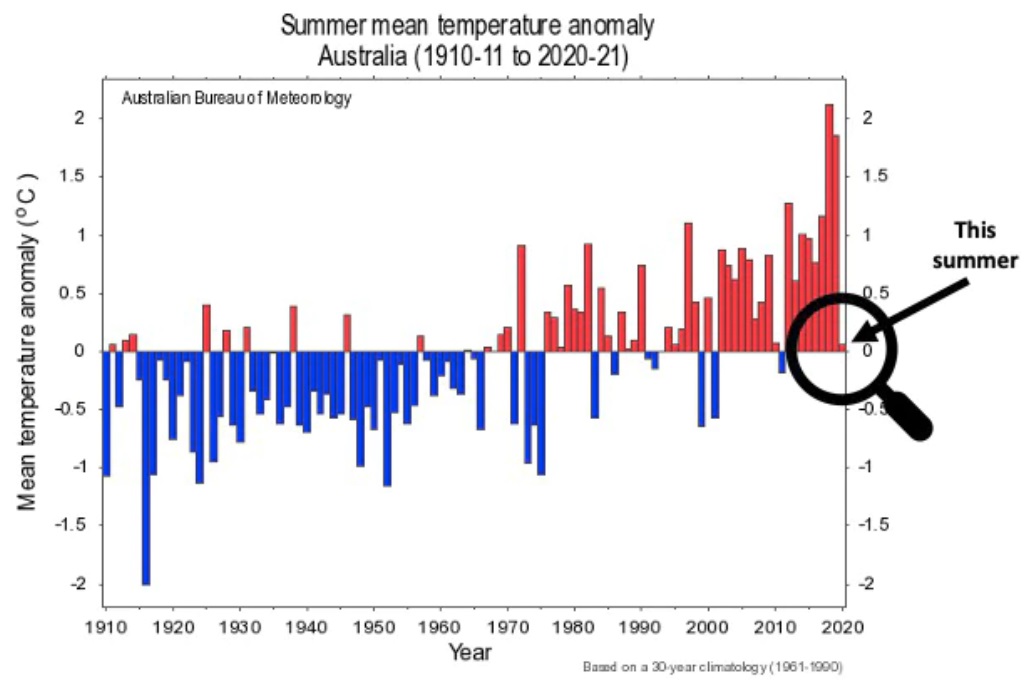

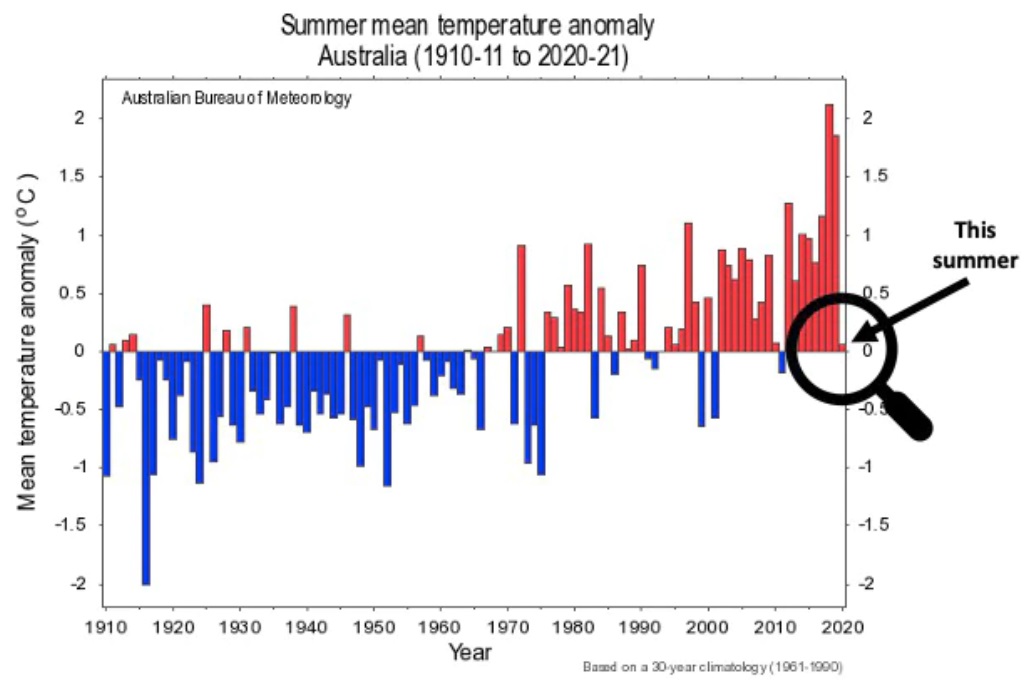

A Cool Summer

Australia had a cool summer thanks to the La Niña climate pattern. We had the coolest summer in nine years. While it sounds much cooler than normal, it was still slightly warmer than the 110-year average. When I was born2 it would have been an average summer, but it’s now a nine-year low thanks to global warming.

The flooding in Queensland and NSW is likely to reduce electricity demand.

From the CSIRO’s Climate Change in Australia page.

How Wholesale Spot Prices Affect Retail Prices

An increase in the average wholesale electricity spot price of one cent per kilowatt-hour from the year before does not mean households will pay exactly one cent more per kilowatt-hour on their retail tariff. This is because…

- The wholesale cost of electricity is only part of electricity bills.

- Contracts set the price for a great deal of generation rather than the wholesale market.

Wholesale electricity prices are only around one-quarter of typical household electricity bills. Other major components are long-distance transmission, local distribution, and retailing costs. If these change, it can cause electricity prices to rise or fall even if wholesale prices stay the same.

Another reason spot prices aren’t a perfect indicator of what will happen with electricity prices is that only some wholesale electricity is traded on the market. The rest is set through contracts, the details of which are kept hidden. Contract prices usually average a little lower than spot prices, but sometimes they are way off. These kinds of mistakes will keep happening until psychics stop working on hotlines for $3 a minute and go where the real money is.

Solar Power Reduces Daytime Prices

Solar panels provide power when the sun is up. If you didn’t know this, the word “solar” should have been a big hint. The more solar generating capacity is built, the lower daytime electricity prices will be. As the cost of electricity falls during the day, it will reduce solar feed-in tariffs. This process will have up and downs, but the overall downward trend will be gradual for three main reasons:

- Because they can’t switch on and off easily, once daytime electricity prices fall too low, a coal power station that’s no longer economical to operate will be forced to permanently shut down. This will — temporarily — raise prices.

- Lower electricity prices during the day mean more consumption gets shifted to the day, slowing the rate daytime prices fall.

- Massive amounts of battery capacity are planned and being built. By buying electricity when its price is low and selling when it’s high, they will help even out extremes and slow the fall in daytime prices.

I don’t expect solar feed-in tariffs to become very low for a decade or more, and I don’t expect them to ever disappear.

Inflation

After falling below 2% for six years in a row, Australian inflation is now back up to around 3%. While this still seems low to someone alive in the 70s3 it is enough to have a noticeable effect on electricity bills. Inflation can make it appear the cost of grid electricity is increasing even if, in real terms, it’s holding steady or even falling.

QLD Prices Will Jump

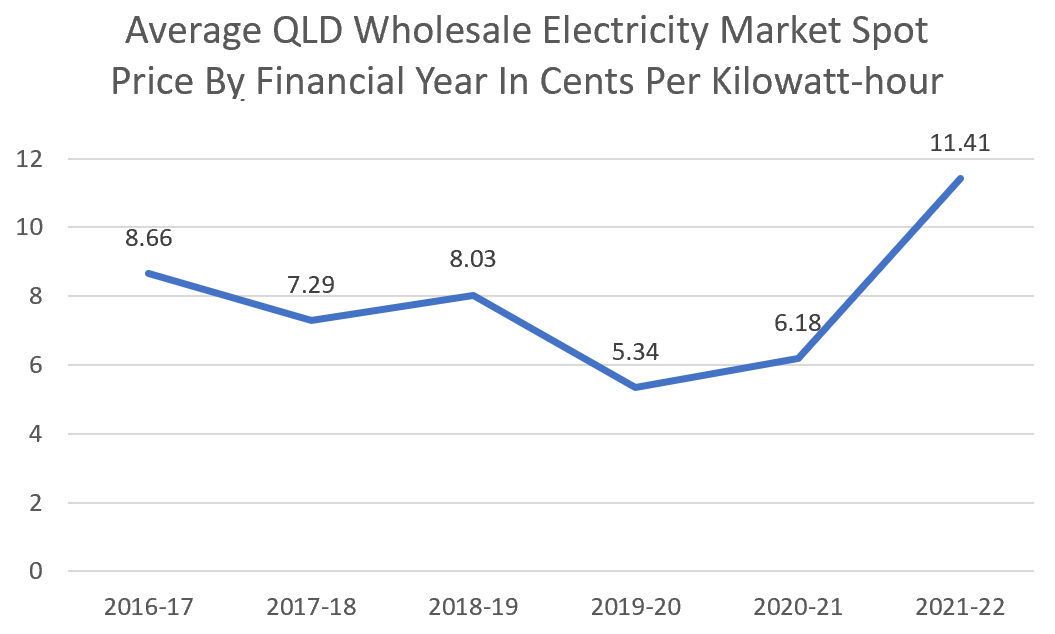

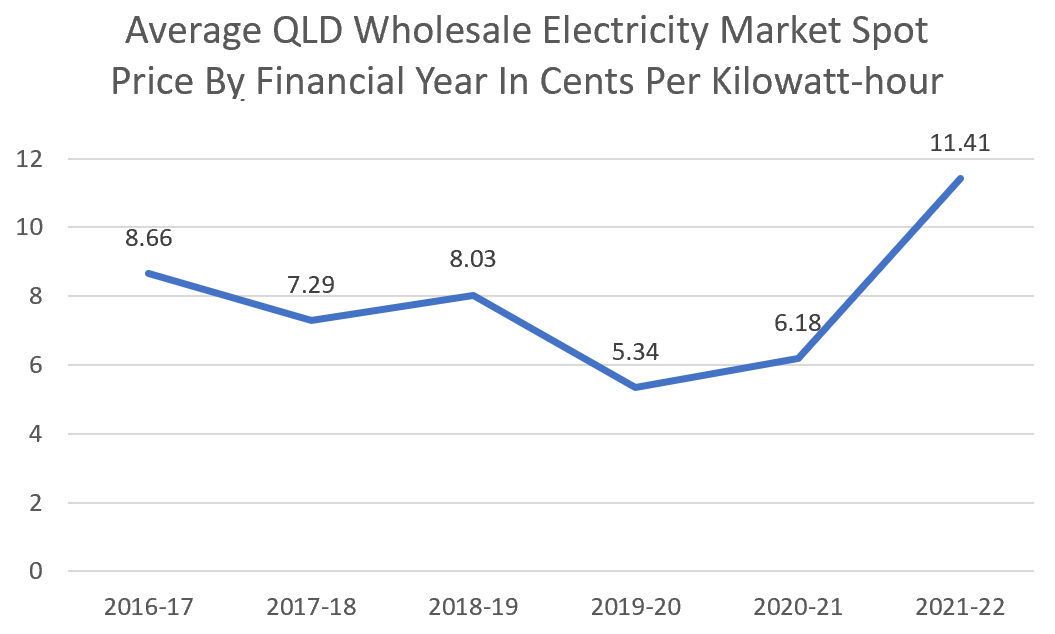

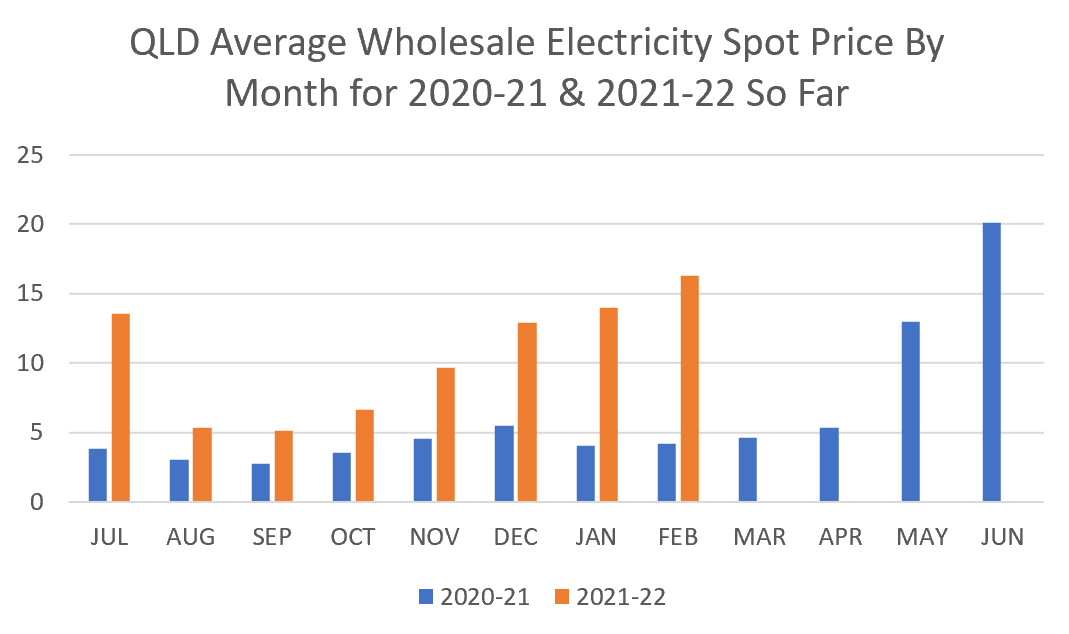

As a large state with a moderate amount of industry, Queensland has fairly consistent average wholesale electricity spot prices. Year on year changes are usually under a couple of cents, as this graph using information nabbed from the AEMO shows:

This financial year has been exceptional, with an average 5.3 cents higher than the previous year. The two main reasons for this large increase were:

- Queensland’s summer wasn’t as cool as the rest of the country.

- An explosion at the black coal Callide Power Station.

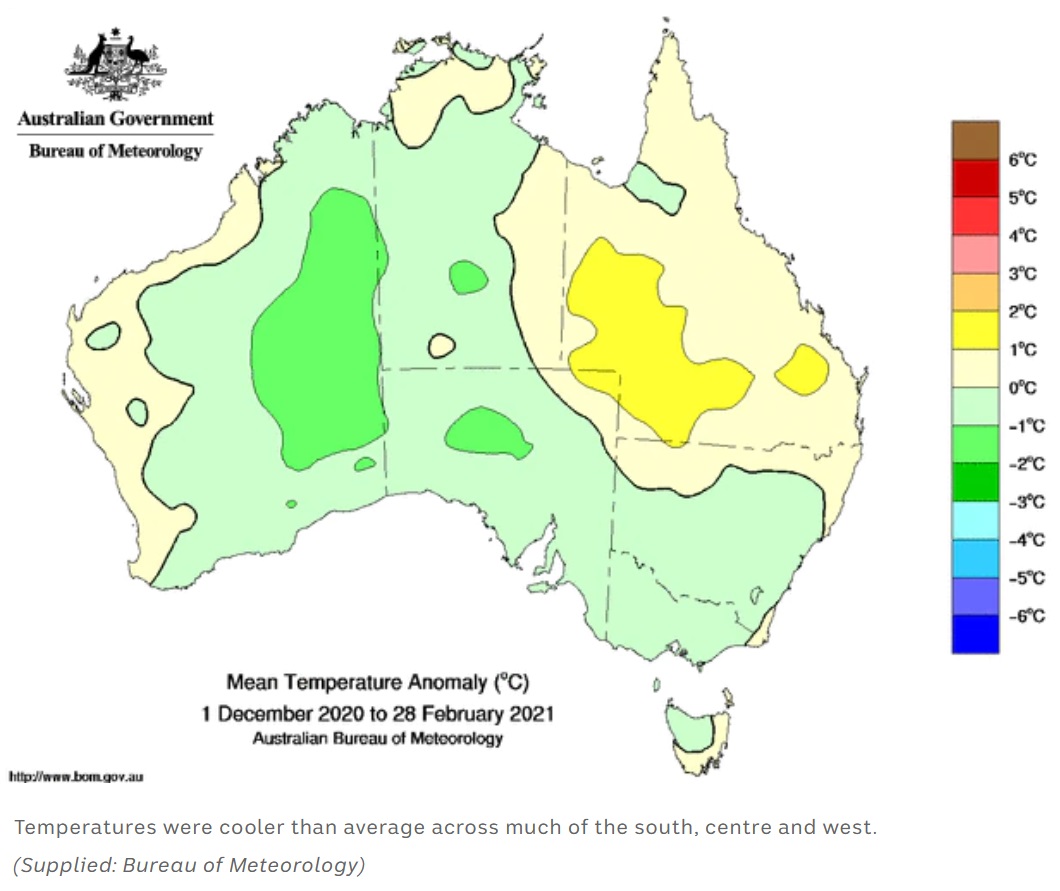

I mentioned we had a cool summer, but Queensland wasn’t as cool as the rest of Australia, as this map shows:

I acquired this map from ABC news who snagged it from the Bureau of Meteorology. It shows that not even La Nina and the Tonga eruption working together could make Queensland cooler than other states…

As you can see, Queensland and the most populated parts of WA were hotter than the rest of the nation. But the map is a little hard to read. Over the past 10 years, the temperature anomaly for Australia has averaged over 1 degree, so the light yellow parts were still cooler than usual for summer these days.

A big reason for the large increase in Queensland wholesale electricity prices was an explosion at the black coal Callide Power Station 80 km from Gladstone in May last year. A 405-megawatt generator decided to blow itself up. It’s not known if it was depressed or, in the race to destroy the planet, it simply decided to come first.

Despite coal being on the way out, $200 million is being spent to repair it4. This is not money well spent, given coal’s significant negative externalities. This is a fancy way of saying it pollutes the air and contributes to global roasting.

Here’s the generator at Callide Power Station that exploded. Clearly, it did a good job of it. Thank god no one was killed. On the bright side, maybe a few more people in Bangladesh will live as a result. (Image: CS Energy)

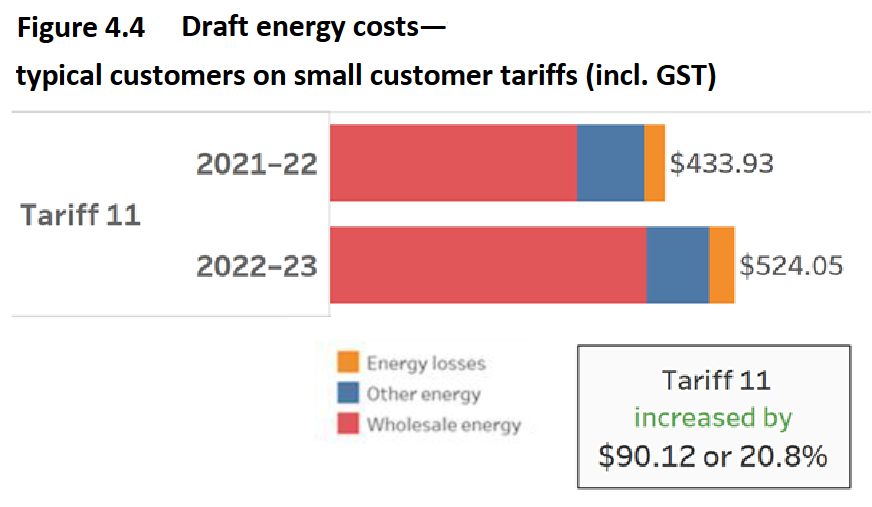

This increased spot prices in all the NEM states, but the main effect was in Queensland. The Queensland Competition Authority (QCA) has said tariff 11, the most common flat retail tariff in regional QLD will rise by about 20.8% in July. This is an increase of 5 cents — very close to the increase in the average wholesale electricity spot price so far this year:

This is a part of figure 4.4 ripped from the Queensland Competition Authority draft determination report: Regulated retail electricity prices in regional Queensland 2022-23.

Because almost all the increase has been due to higher wholesale electricity prices, I expect an increase in Queensland solar feed-in tariffs of 4 cents or more. This will make Queensland’s the highest in the nation. Despite the increase in electricity prices, most homes with large solar systems will come out ahead. Rooftop solar in Queensland is about to go from a great investment to a superb one.

This graph of the monthly average wholesale electricity spot price shows them shooting up in May last year with the loss of 405 megawatts of coal generating capacity at Callide Power Station.

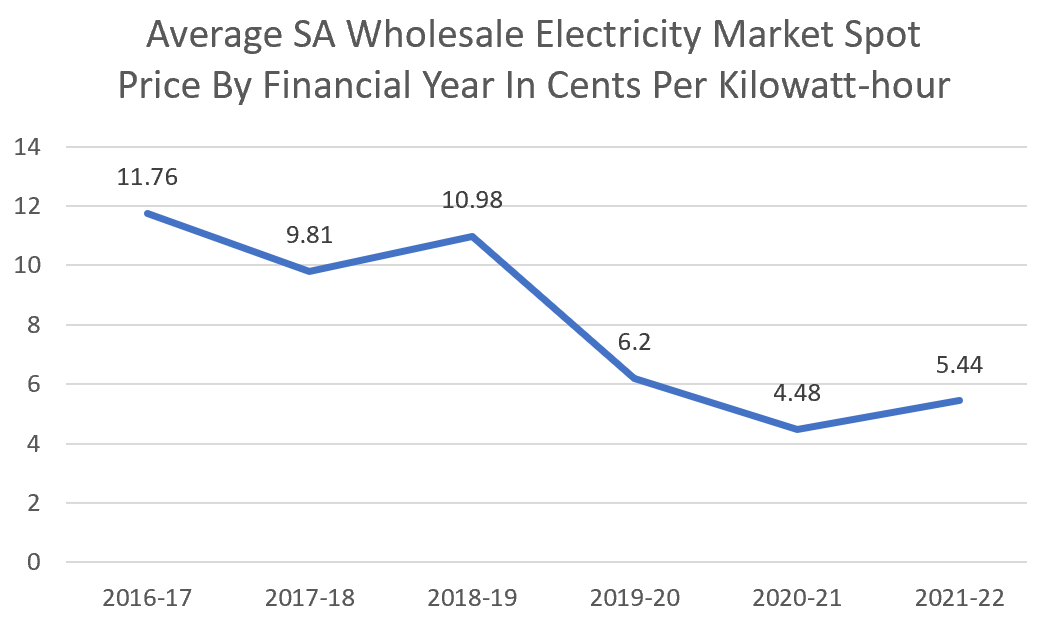

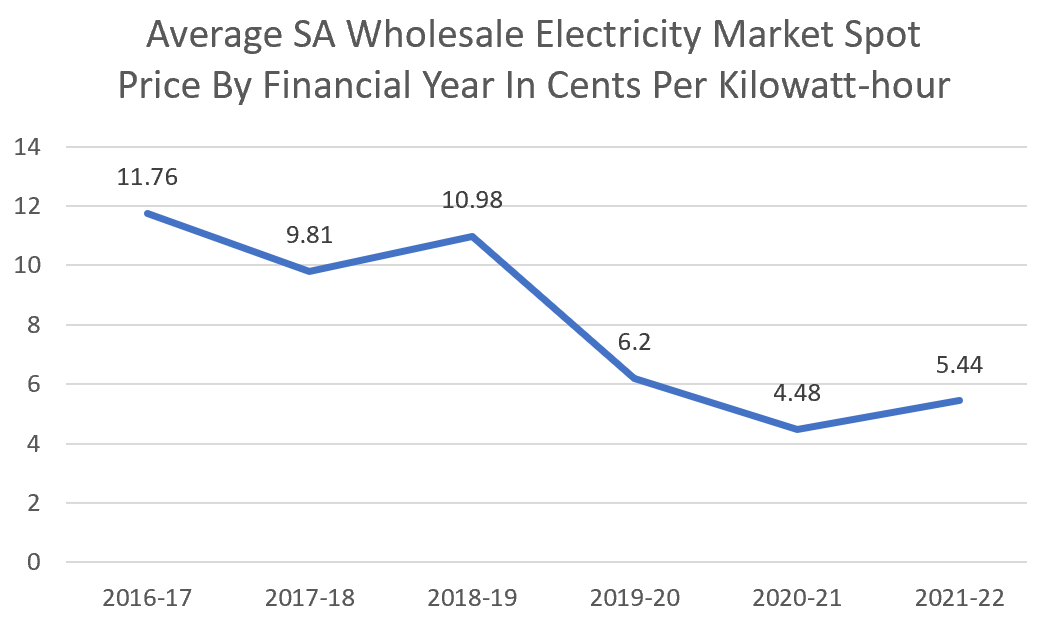

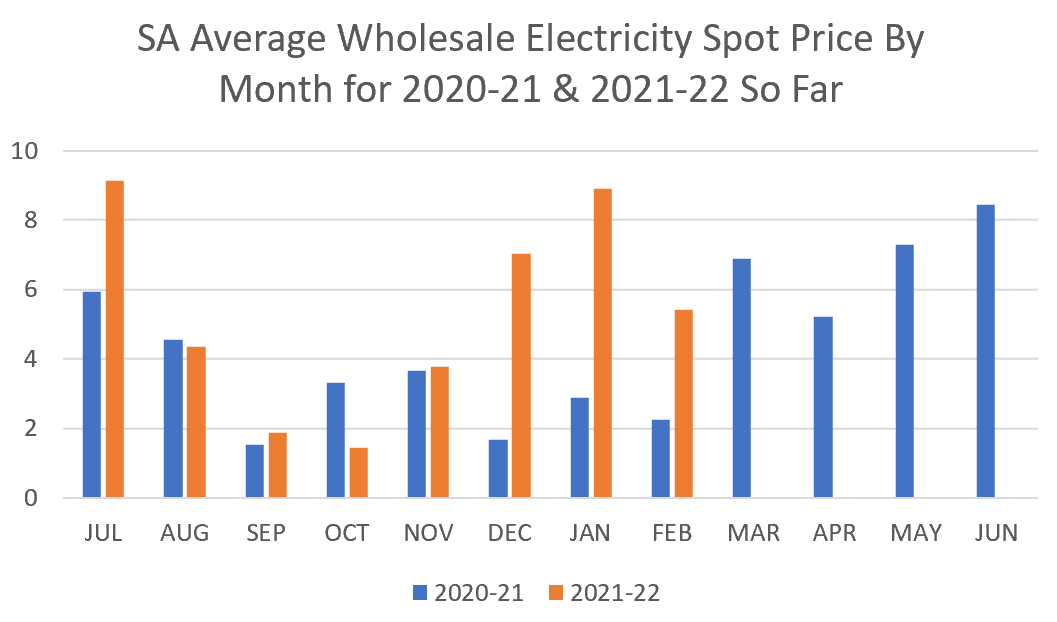

South Australia Will See A Modest Increase

South Australia has a small population of 1.8 million, little industry, inadequate competition in the electricity market, and extremely high electricity consumption in summer heatwaves. This means the average annual wholesale electricity spot price can vary greatly from year to year:

Fortunately, South Australia has invested a lot in wind and solar energy generation, with most of the solar installed by households. Because these renewable sources of generation have zero fuel cost, they are very good at pushing down electricity prices. They have reduced South Australia’s from the highest in the nation to the middlest.

Because SA generates more electricity from gas than any other, it is more vulnerable to invasion related gas price increases..

Compared to the previous financial year, wholesale spot prices have increased by 0.9 cents. All else equal, I’d expect to see electricity prices increase by around that much, with solar feed-in tariffs in SA increasing by close to that amount.

This graph shows average spot prices by month were much higher in summer this financial year than the one before, but they would have been higher still with a hotter summer. SA also had the lowest monthly average of any state. This occurred in October due to solar and wind capacity’s ability to push wholesale prices down.

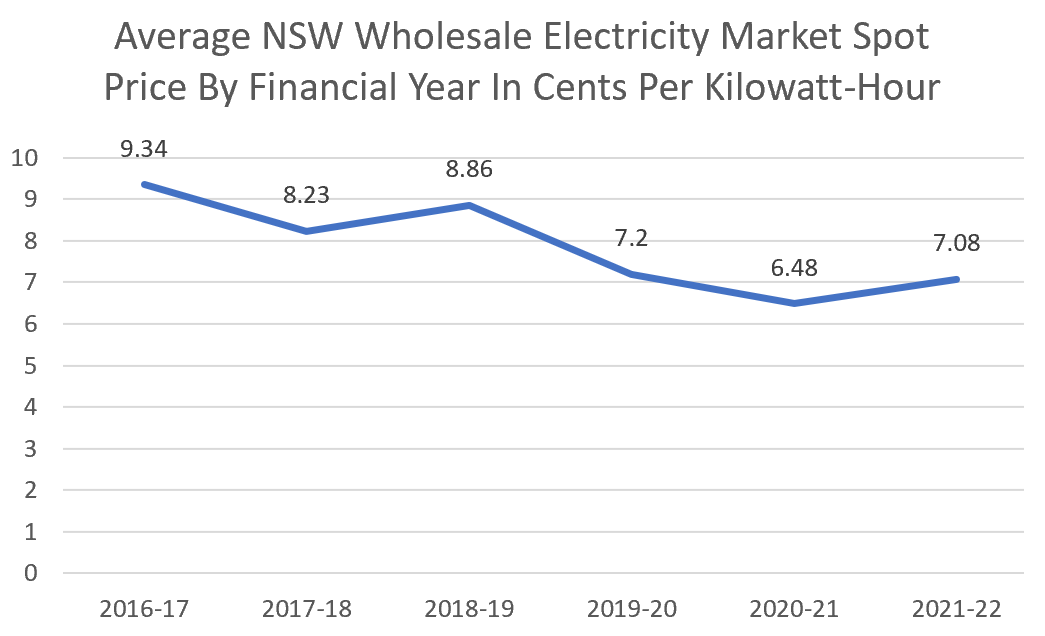

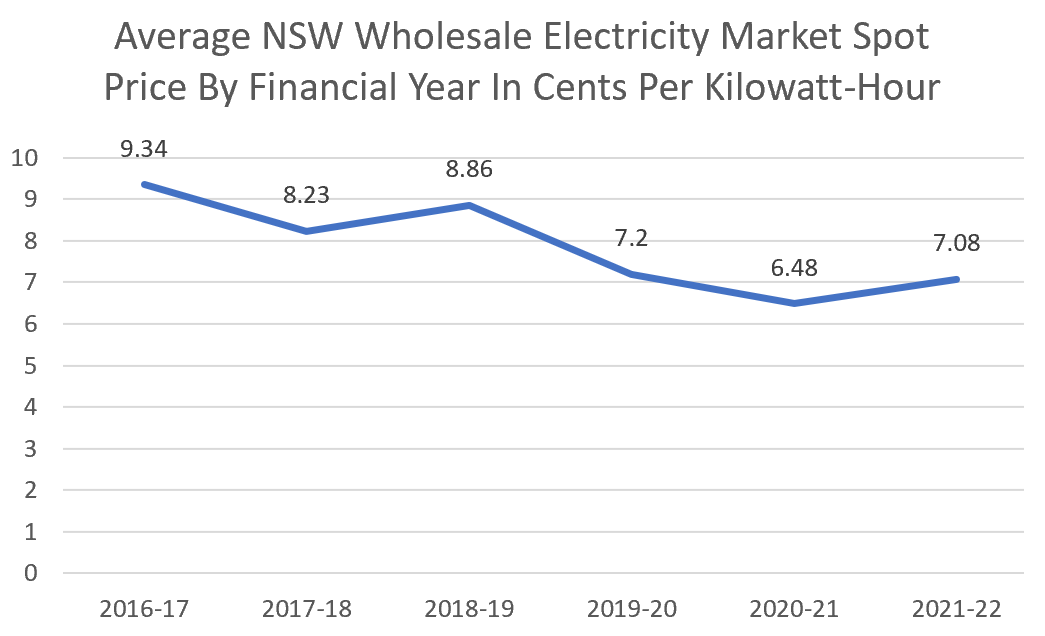

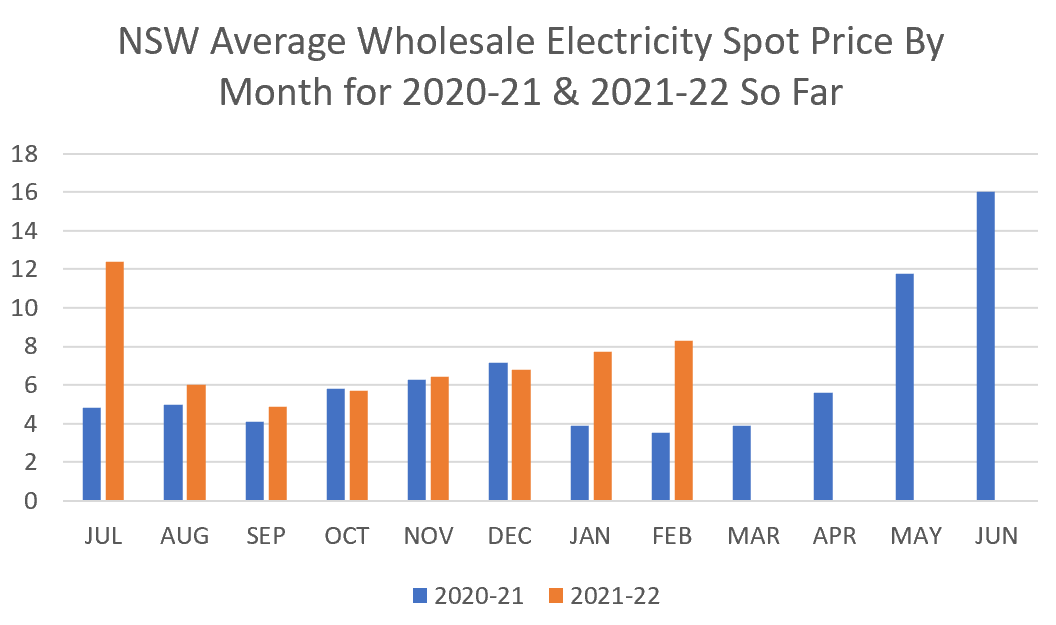

NSW Retail Prices To See A Small Increase

NSW is the largest state by population, has plenty of industry by Australian standards, and — most importantly — the majority of inhabitants live in a climatic cheat zone of beautiful weather. This makes their wholesale electricity prices the steadiest in Australia. They generally change by under one cent per year:

So far, the state’s wholesale electricity market spot prices are up 0.6 cents over the previous financial year. Assuming other components of electricity bills remain the same, electricity prices are likely to rise by around this amount and solar feed-in tariffs in NSW by almost the same.

You can clearly see the NSW monthly average spot price rising in May as prices were pushed up in neighbouring Queensland because of the Callide coal power kablooey .

Tasmania — Meh…

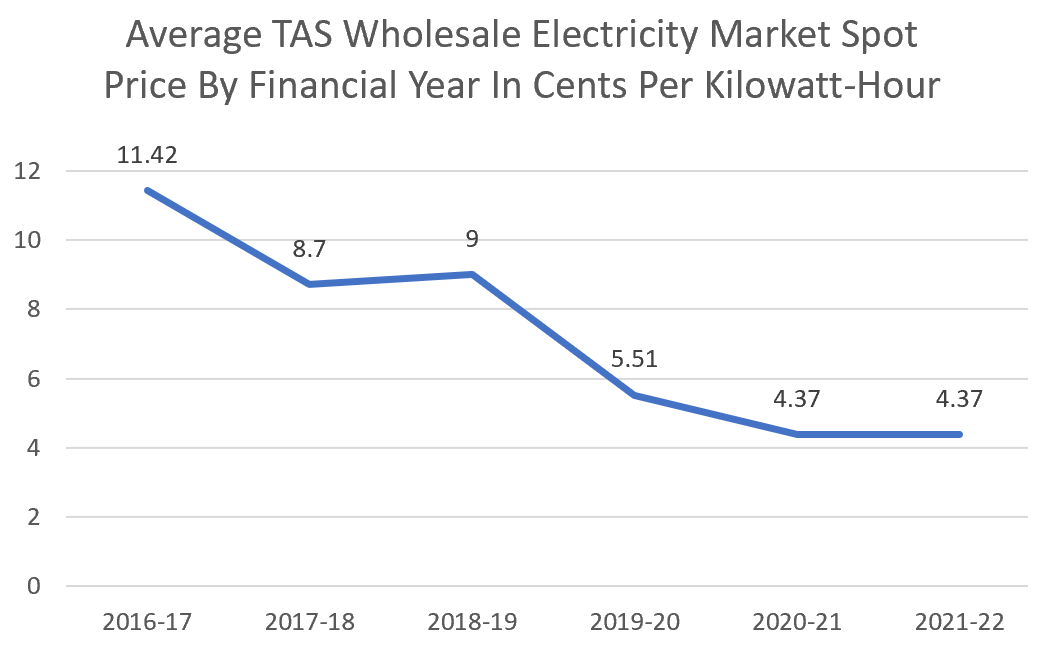

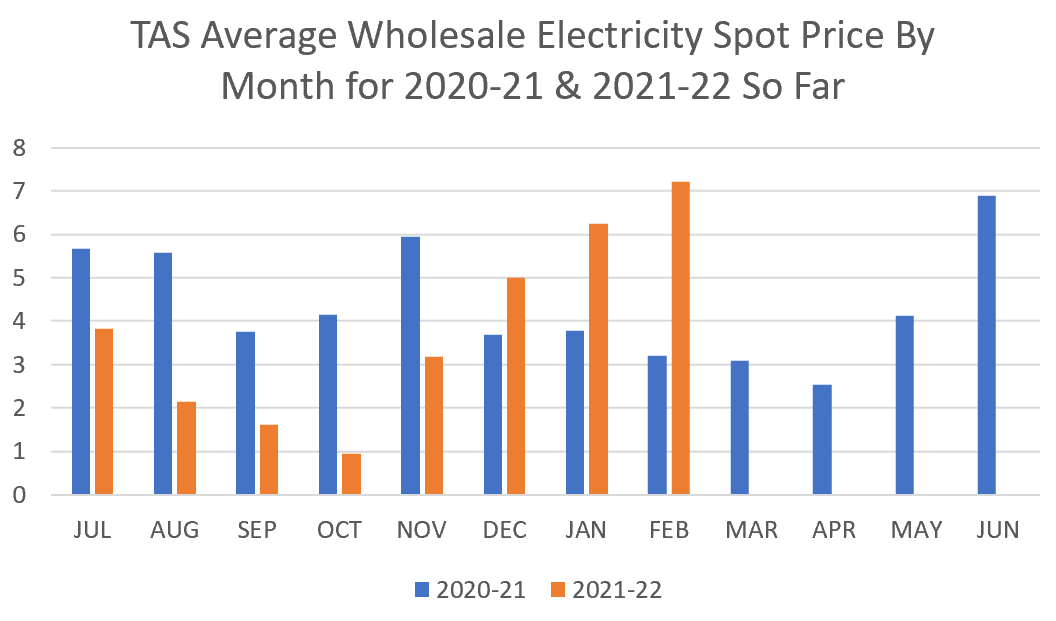

Tasmania’s electricity prices can show a lot of variation from year to year:

Factors affecting Tasmanian wholesale prices are:

- Prices in Victoria.

- How much rain has filled the state’s hydroelectric dams that supply, on average, around 85% of electricity generated in the state.

- Whether or not the Basslink High Voltage Direct Current (HVDC) cable to the mainland is working.

The Basslink interconnector conked out in December 2015 and was repaired in June 2016. High prices in the 2016-17 financial year were mostly because they were high in Victoria.

So far this financial year, mainly by chance, average wholesale spot prices are the same as they were the previous financial year. This may change over the next few months, but I don’t expect any real shift in Tasmanian electricity prices and no significant change in feed-in tariffs in TAS.

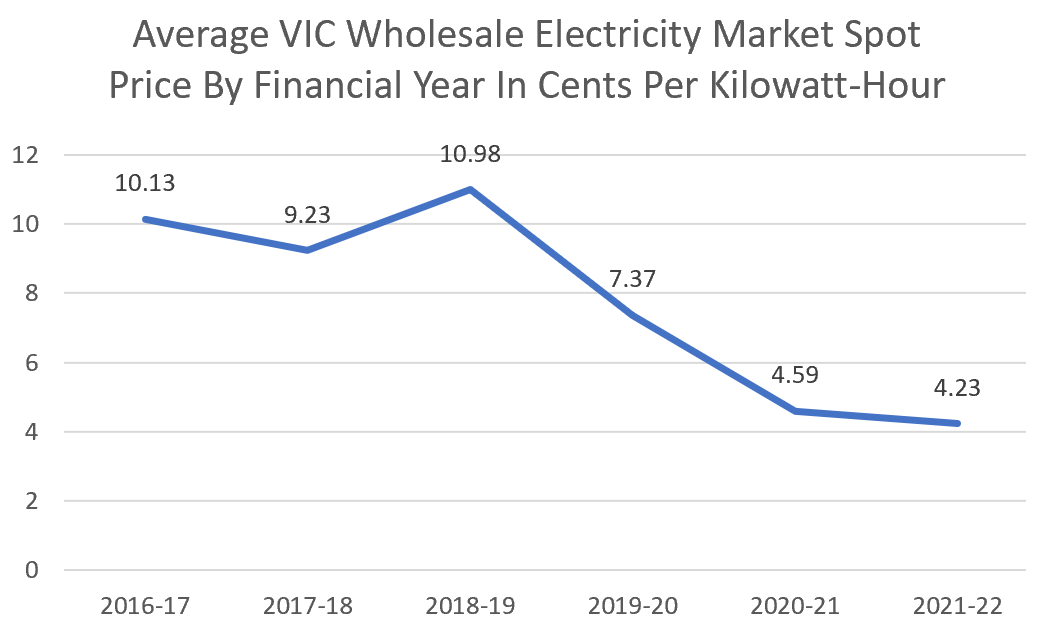

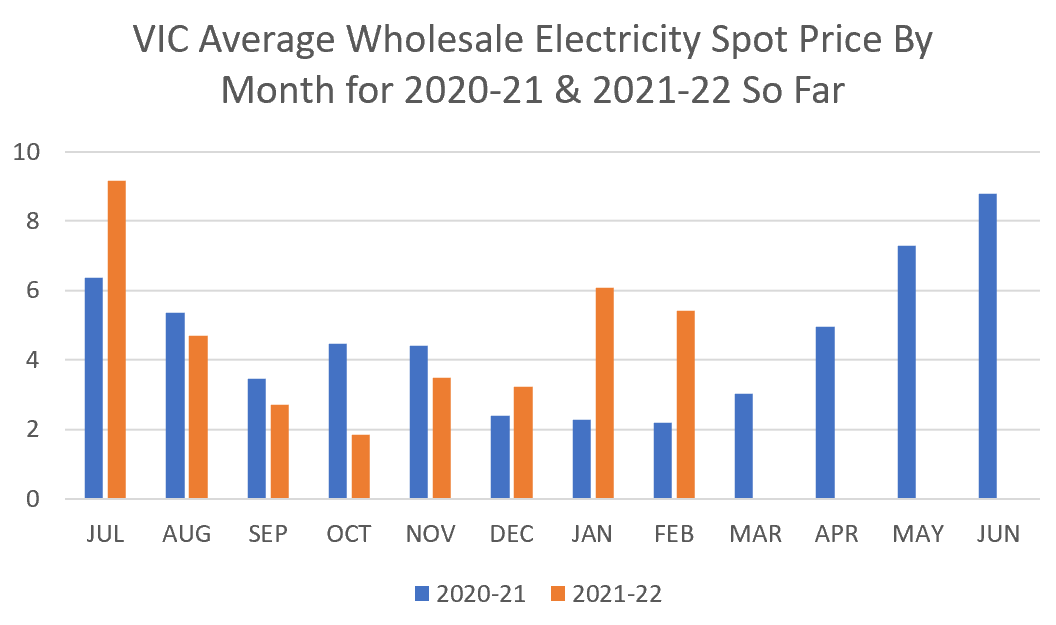

Victoria Will Get A Small Decrease

With the second-largest population, a considerable amount of industry, and a climate that isn’t extreme5, you might expect Victoria to have fairly steady average annual wholesale electricity spot prices like NSW. But this hasn’t been the case lately:

Victorian wholesale electricity prices were high five years ago because the brown coal Hazelwood Power Station closed down with only a few months’ warning. The horribly polluting power station was simply too unsafe to operate. I’d say this applies to every coal power station but in this instance, it applied to the people inside the power station, not outside it.

Between COVID, a cool summer, and a little help from increasing renewable generation, Victoria had a slight fall in its average wholesale electricity spot price. So far it has fallen 0.36 cents from last financial year. This decrease won’t be very noticeable on bills, but Victoria’s Essential Services Commission has announced a significant cut in the state’s minimum feed-in tariff from 6.7 cents to 5.2 cents in July. The reasons given for the 1.5 cent drop were low daytime wholesale prices and expected low wholesale prices next financial year. But this is only the minimum feed-in tariff. Some retailers are offering more.

Despite the coming fall in the minimum feed-in tariff in VIC and the least sunshine of any mainland state, solar can still make excellent financial sense in Victoria. This can be especially true with the $1,400 Victorian Solar rebate. This amount is available for most homes that don’t already have solar until the 30th of June. After this, it shouldn’t disappear but it will be reduced.

Future Trends

I know I said prediction is hard, but If economic growth is as strong as predicted in February, I’d expect further wholesale price increases in the 2023-24 financial year. But with Russia starting a land war in Eurasia, what the world economy will be like in a year is anybody’s guess6. I’m going to cross my fingers and hope for peace and a healthy world economy.

La Niña should end around July, so I expect next summer will be hot but still cooler than average for the 21st century. After that, summers are likely to go back to being stupid hot. The hotter the summer, the higher wholesale electricity prices will be.

The decommissioning of NSW’s black coal Liddell power station will be completed in April next year and will be followed by the huge black coal Eraring Power Station, also in NSW, in August 2025. The rate of coal power station closures is only going to accelerate.

It’s impossible to be certain what will happen, but with a stronger economy, hotter summers, and coal power stations lining up to be allowed to shut down, my guess is — despite increasing solar, wind, and battery capacity — both wholesale electricity prices and solar feed-in tariffs will generally be higher for the next two to three financial years compared to this financial year. But note I don’t expect the high prices coming to Queensland to last, as the Callide Power Station may be repaired by the end of this year.

I am sure that there will be more problems with coal power stations failing in Australia before they’re all closed. If you have solar panels, you’re protected against coal power failures because any increase in wholesale prices caused by coal’s unreliability should also push up solar feed-in tariffs. Except in WA. It seems everyone gets screwed out west.

Footnotes

- Last year natural gas only provided 7.7% of Australia’s electricity, but it plays an important role in setting prices. This will decrease as more battery storage is built.

- Those rumours about me being born in a paleolithic ice age are substantially untrue.

- If you think the 70s were bad, back in 1796 there was over 100% inflation in France. So I’ve been told. I wasn’t alive then because those stories about me being born in the Paleolithic are just rumours.

- it’s one of Australia’s younger coal Power Stations at “only” 21 years old

- The weather in Melbourne has no idea what it’s doing, but that’s not the same thing.

- If Putin detonates enough atomic bombs in one location it can create a nuclear winter as cold as a Paleolithic glacial period. Not that I personally know what they were like, because I wasn’t born then.

Original Source: https://www.solarquotes.com.au/blog/feed-in-tariffs-electricity-prices-2022/