SMA Solar’s Struggles Continue

If German solar inverter manufacturer SMA Solar Technology AG was Australian, the firm would certainly qualify for the “battler” label.

Founded in 1981, SMA was hugely popular among Australian solar installers some years back. But after years of spruiking its “Made In Germany” credentials and in the face of increasing competition from China, the company took the “if you can’t beat them, join them” route. SMA started manufacturing single-phase Sunny Boy solar inverters in China in 2017. SMA already had some experience with manufacturing in China through its acquisition of a majority stake in Zeversolar back in 20121.

SMA was a little shy about its activities in China, which isn’t surprising given its previous opposition to manufacturing inverters there. But in 2019, the company decided to discontinue outsourcing production and development activities to China and to ramp up production in Germany. The road has been anything but smooth since then, but the firm battled on.

Things seemed to be getting rosier, with the company reporting an “extraordinarily strong” 2023 in March this year. In May, SMA said the first quarter of 2024 was in line with expectations, with group sales totaling €361.8 million – around the same as Q1, 2023.

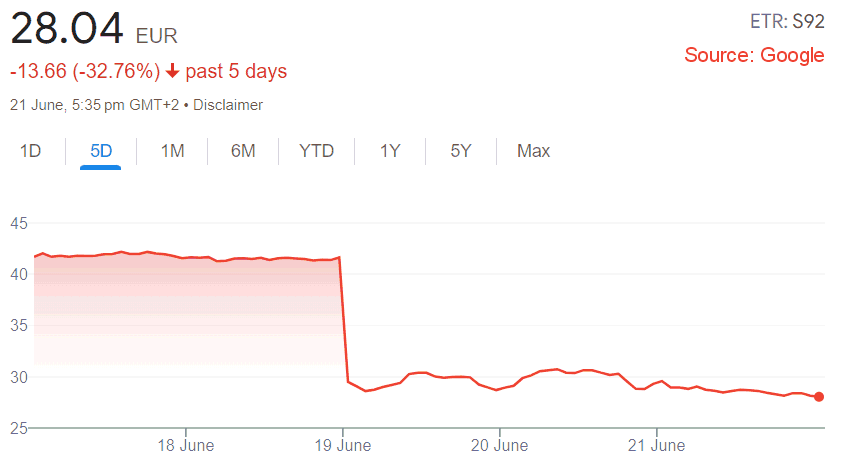

Profit Warning Sees SMA Shares Slump

But last week the company said it was adjusting its guidance for the fiscal year 2024 downwards; expecting sales of between €1.55 billion and €1.7 billion, compared to €1.95 billion and €2.22 billion previously. The operating earnings forecast before interest, taxes, depreciation and amortization (EBITDA) was revised downwards to between €80 million and €130 million, previously €220 million and €290 million.

Among the reasons given for adjusting guidance were a “persistently volatile market” along with a delayed increase of incoming solar inverter orders. This was a result of continued high inventories at distributors and installers, which is affecting the home, commercial and industrial segments.

“Furthermore, there is new uncertainty in the market due to the recent outcome of the European elections and the upcoming elections in the USA on November 5th.”2

While SMA says its large-scale and project solutions segment is continuing to develop in line with expectations, investors didn’t take the news too well. SMA shares plunged nearly 32% from €41.64 to €28.60 after the announcement, before closing out the week at €28.04.

SMA’s Australian Home Solar Fortunes Fade

SMA was once one of the most popular inverter choices in Australia for home solar installations. As an indicator of how the tide has turned, the company didn’t score a spot on the podium in SolarQuotes’ Installers Choice Awards for the best solar inverters in 2024 – or in 2023, or in 2022 for that matter. It managed to place equal third in 2021.

But given the quality of SMA products and support at this point, the company is still listed as an SQ-recommended solar inverter brand and Australian customer SMA inverter reviews are still generally positive.

An inverter is the workhorse of a PV system, taking all the output of the solar panels and converting it to supply that can be used by appliances in a home and exported to the grid. It does this under all sorts of harsh environmental conditions; day-in, day-out for many years – or it should if you choose the right one. Discover everything you need to know about solar inverters.

Original Source: https://www.solarquotes.com.au/blog/sma-solar-struggles-mb2948/