Major Chinese Solar Manufacturers’ Revenues Plummet

There’s been a flurry of financial and shipments reporting from some of China’s – and the world’s – biggest solar players in the last couple of weeks. Here’s how some have fared during what is (revenue-wise) a big dip on the solar coaster.

Daqo – “Significant Challenges”

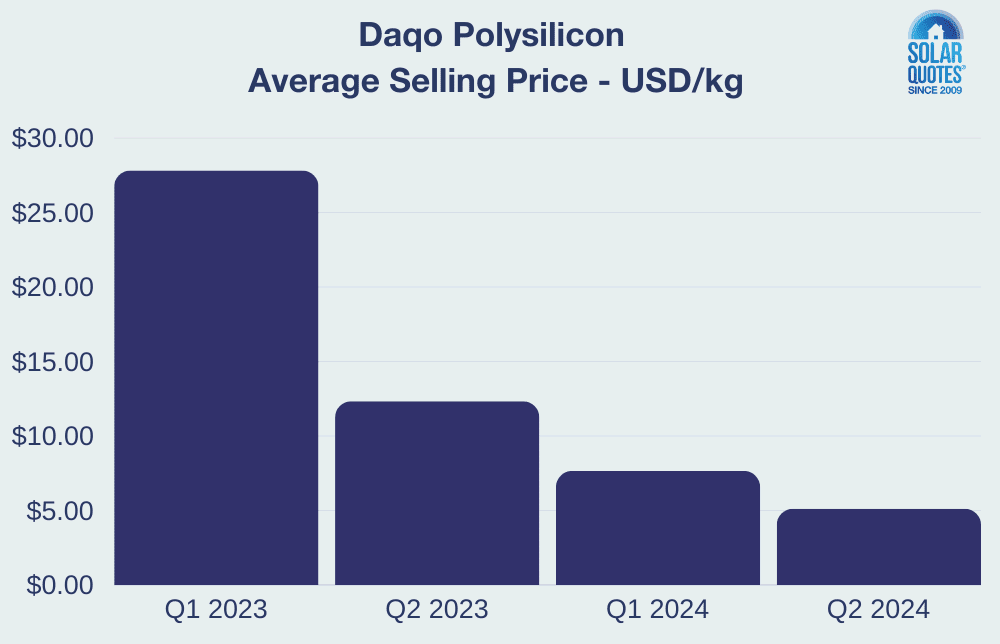

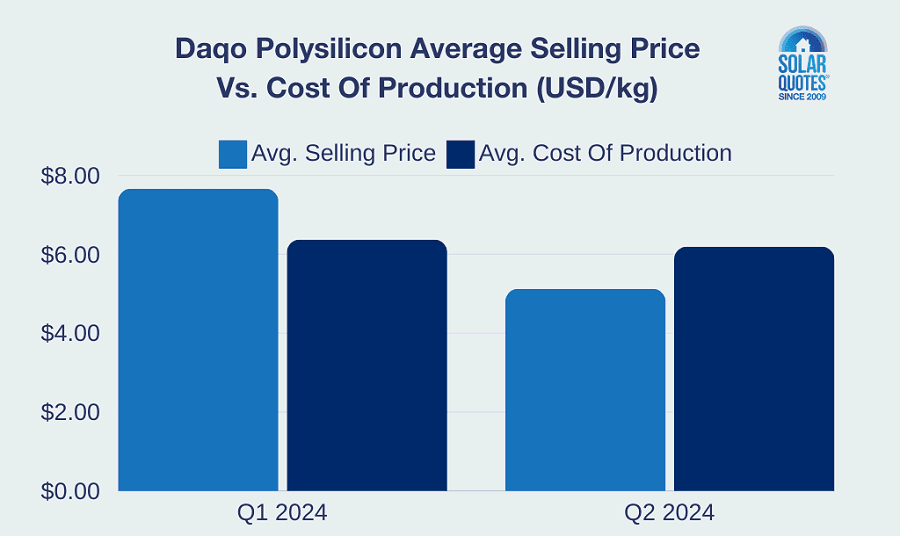

In late August, polysilicon producer Daqo announced its unaudited financial results for the second quarter of 2024, indicating polysilicon production volume of 64,961 metric tonnes (MT) for the period compared to 62,278 MT in Q1 2024. But revenue was USD $219.9 million in Q2 2024, compared to $415.3 million in Q1. This was due in part to a polysilicon average selling price of $5.12/kg, compared to $7.66/kg in Q1 2024.

Looking back even further, the average selling price in Q2 2023 was $12.33/kg, and $27.83/kg in Q1 2023.

That wasn’t good news in itself, but made even worse by the average total production cost of polysilicon during Q2, 2024 of $6.19/kg – $1.07 *more* than the average selling price.

Commenting on the results, Daqo New Energy CEO Xiang Xu said:

“The solar industry experienced significant challenges during the second quarter, as market prices fell across the solar value chain to below production costs for nearly the entire industry.”

Daqo has adjusted its target production range downwards for the third quarter to 43,000 – 46,000 MT and for the full year down to 210,000 MT to 220,000 MT – previously it was 280,000MT to 300,000MT.

Longi – “Strong Resilience”

Solar wafer, cell and panel manufacturer Longi released its semi-annual report for 2024 in the last week of August. During the first half of 2024, the company achieved revenue of 38.529 billion yuan (64.652 billion in H1 2023). Silicon wafer shipments (external sales) totaled 21.96 GW, compared to 22.98 GW in H1 2023, while external solar cell sales reached 2.66 GW – down on the 3.28 GW for the same period last year. Shipments of Longi solar panels amounted to 31.34 GW, up on H1 2023’s tally of 26.64 GW.

Choosing to put a positive spin on the results, Longi stated:

“Despite the significant decline in industry chain prices and inventory impairment provisions, the company demonstrated strong resilience and adaptability in the market.”

Trina Solar – Profitable

Trina published its financials for the first half of 2024 in the last week of August, reporting revenue of USD $6.047 billion, compared with $7.13 billion for the same period last year. The company says it achieved a net profit of $74.058 million for H1, 2024.

The company shipped 34GW of Trina Solar panels, 25.9% more than in the same period last year. Also shipped were 1.7GWh of DC container and Trina battery storage systems, and 3.2GW of solar mounting systems.

JinkoSolar – “Increasingly Irrational Prices”

JinkoSolar announced its unaudited financial results for the second quarter ended June 30, 2024 on August 30. While total revenues were up 4.4% on the previous period to US$3.31 billion, this was down 21.6% year-over-year. Quarterly shipments of JinkoSolar panels were 23,822 MW, up 34.1% year-over-year, and 1,496 MW of cells and wafers were shipped.

Among his comments on the company (and industry’s) performance; JinkoSolar’s Chairman and Chief Executive Officer Mr. Xiande Li said:

“Oversupply and increasingly irrational low prices along the supply chain that have plagued our industry for some time have started to be addressed by market forces as well as government and industry control policies.”

The CEO says the company expects expect module shipments of between 23.0 GW and 25.0 GW for the third quarter of 2024.

Will Solar Panel Prices Go Much Lower?

Cut-throat competition may have Chinese producers crying in their baijiu – and manufacturers elsewhere in their respective national alcoholic beverages – but end-consumers are benefiting price-wise with cheaper solar panels.

However, something’s got to give at some point – and that might be around now.

The situation means it’s even more important to choose solar panels wisely, as some manufacturers may not survive this. It could also be an unsettling time for some local importers/installers as they may be fully on the hook for warranty if a manufacturer goes bust.

In terms of waiting a bit longer to see if panel prices drop further, the best time to install a solar power system is usually right now. Waiting means electricity bills in the interim much higher than they would otherwise be, and any potential savings from holding off could be chewed up by the difference.

Original Source: https://www.solarquotes.com.au/blog/chinese-solar-struggling-mb3003/