What Is 5-Minute Settlement And How Does It Help Batteries?

On October 1st, Australia’s National Electricity Market is changing from 30-minute to 5-minute settlement.

In this article, I’ll explain exactly what Australian households need to do to prepare for this event. This is easy because what’s required is…

…absolutely nothing.

While all grid users will benefit from the coming change, there’s nothing households have to do. Unless you’re in the business of selling wholesale electricity, you can chill.

But if you happen to own a coal power station, you are permitted to sob with impotent rage. This is because, a sweet, long-standing arrangement favouring fossil fuels will disappear. If you find you’re physically incapable of crying, please feel free to crack open one of your finest bottles of orphan tears.

While consumers won’t need to do anything, benefits from the change will include…

- Lower electricity prices.

- Higher profitability for utility-scale batteries and Virtual Power Plants (VPPs).

- Increased benefits to households from joining a VPP.

- More battery capacity. This will aid the integration of renewables into the grid and increase the pace fossil fuels are phased out.

- Create opportunities for households to save money use smart home energy management in the (hopefully) near future.

What’s A Settlement Period?

In Australia’s National Electricity Market — or NEM to its friends — the dispatch of electricity by larger generators is based on 5-minute periods. This is a convenient length of time because, barring disaster, electricity demand doesn’t change fast enough to cause problems over the time it takes Yoda to sing about his stick.

[embedded content]

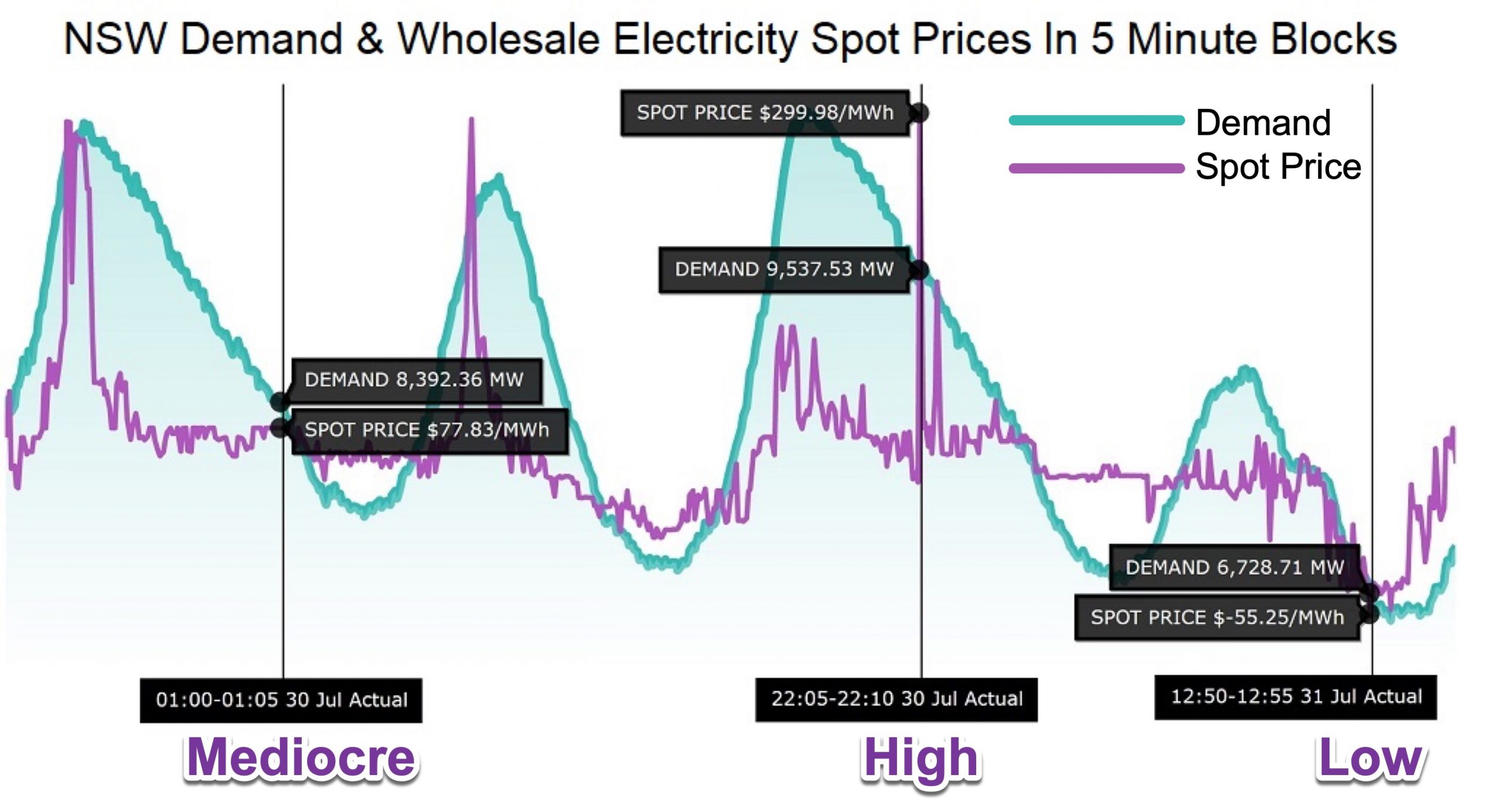

This graph from the AEMO shows electricity demand and wholesale electricity spot prices for the 5 minute dispatch periods. It covers three days in NSW ending at 3:30 pm on Saturday, July 31st.

On the graph, spot prices are given as dollars per megawatt-hour. Divide those numbers by 10 to get cents per kilowatt-hour.

I’ve shown the spot price at three different points on the graph. From left to right they are…

- A mediocre price: 7.783 cents per kilowatt-hour

- The highest price: 29.998 cents per kilowatt-hour

- The lowest price: -5.525 cents per kilowatt-hour

The lowest price is interesting because it’s negative. This occurs when there is too much electricity being supplied to the grid and forces generators to pay to generate. This encourages them to generate less electricity. While generators don’t like negative prices, large businesses and some households exposed to wholesale electricity prices enjoy being paid to consume electricity.

Anyone with a battery who can buy and sell electricity at the spot price of these 5-minute blocks clearly has an incentive to charge that battery when prices are negative and sell the stored energy when the price is high. This way they make money both coming and going.

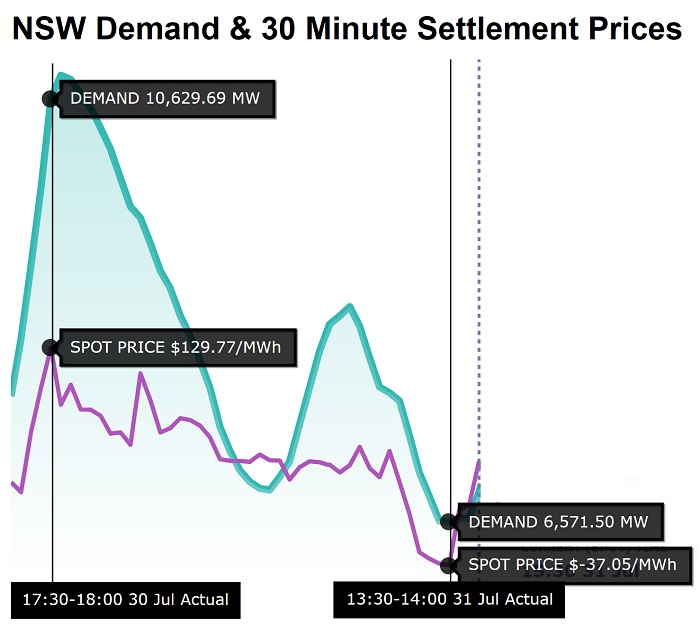

But at the moment generators aren’t paid in 5-minute blocks. Instead, the 5-minute prices are averaged over 30 minutes. This is known as 30-minute settlement. The graph below shows 30-minute settlement prices over a 24 hour period in NSW:

This graph for NSW covers 24 hours ending at 3:30 pm on Saturday, July 31st. So it’s the same period of time as the right third of the previous graph.

The highest and lowest 30-minute settlement prices are shown on the graph. This is what generators are paid for all the energy they supply in a half-hour period. Because they’re an average of six blocks of 5 minutes each, these prices are less extreme. In other words, the highest price isn’t as high and the lowest price isn’t as low.

| Highest Price c/kWh | Lowest Price c/kWh | |

|---|---|---|

| 5-minute settlement | 29.998 | -5.525 |

| 30-minute settlement | 12.977 | -3.705 |

30-minute pricing benefits sluggish generation such as coal power plants, while screwing over fast-acting energy storage such as batteries.

Why 30 Minute Settlement?

Back in 1998 when the National Electricity Market came into official existence, 30-minute settlement was selected over 5-minute settlement, despite the shorter period looking like the logical choice.

One reason given is for this is communication technology wasn’t as advanced back then. But I suspect the choice was mostly based on conservatively copying overseas electricity markets overseas that worked, along with an arse-covering aversion to trying something new. I also believe little or no consideration was given to the potential future role of renewables or energy storage.

Rather than design a system from the ground up where pay-period and electricity-dispatch periods were the same, it’s now being fixed 23 years later. That seems a bit bloody long to me. The decision wasn’t made until the 28th November 2017, and came about thanks to large electricity consumers complaining about being ripped off by generators. The introduction date was then delayed three months on account of COVID and so is now starting October 1st.

Benefits Of 5 Minute Settlement

This AEMO factsheet gives three benefits of introducing 5-minute settlement. I’ll introduce them one at a time:

With 5-minute settlement, more nimble and flexible generators will have an advantage over Australia’s old, inflexible coal generation. Batteries will have an advantage over all fossil fuel generation because, as this article describes, all fossil fuel generation has:

- Start-up costs

- Start-up times

- Minimum levels of stable output

None of these issues applies to batteries, thanks to having no moving parts. This lets them react far faster than any fossil fuel generator and immediately take advantage of 5 minute periods of high or low electricity prices.

As batteries are no longer held back by a pay period custom made for fossil fuel plodders, they will be more profitable, so companies will build more. It’s no accident the world’s largest battery is scheduled for completion in Victoria on November 1st, one month after 5-minute settlement is introduced1. Increased battery capacity hastens the rate cumbersome old fossil fuel capacity is shut down.

Demand response is when electricity users change consumption in response to prices. It’s difficult for a business to turn off air conditioning or refrigeration for 30 minutes, but it’s easy for a 5 minute high price period. It’s also easy to do the opposite and crank up air conditioning, refrigeration, and other consumption during a five minute low price period.

The behaviour change this encourages will lower electricity costs for large businesses, while also reducing how extreme the price differences are between 5-minute settlement periods.

This is a polite way of saying it will make it harder for generators to game the system to their own advantage. When a large generator gains sufficient market power thanks to a supply constraint or lack of competition, a common tactic is to bid at a sky-high price for five minutes and then rock bottom prices for the rest of the half-hour.

The lower prices ensure most of their generation is used, but the sky-high 5 minute bid increase the price paid to the generator when averaged over the half-hour. It is, of course, consumers who end up paying, so we’ll benefit from lower electricity prices once this cheat code is eliminated.

Big Batteries & VPPs To Benefit

Only large utility-scale batteries and VPPs can directly benefit from 5-minute settlement. I’m not aware of any home battery system that allows households to benefit without being a member of a VPP. One indirect benefit to households is payments VPPs offer those who join should increase, as they’ll be able to make more money from exploiting other people’s batteries.

Battery households that don’t join VPPs may be worse off. 5-minute settlement will increase the amount of battery capacity on the grid, potentially reducing the price difference between peak and off-peak rates. The smaller the difference, the lower the return from home batteries using these tariffs.

In the future, we may see smart home battery and energy management systems that give households the lion’s share of VPP profits to the household – not the VPP operator. That would be nice, but I don’t recommend holding your breath.

Footnotes

- It remains to be seen if the opening of the Victorian Big Battery will be delayed due to the recent fire that occurred during testing. ↩

Original Source: https://www.solarquotes.com.au/blog/nem-5-minute-settlement/