Uri’s Story: How the Inflation Reduction Act Can Help This Future EV Driver Save

The Inflation Reduction Act is recognized as the most significant clean energy legislation in U.S. history. But what can the average American expect to gain from the new law’s incentives? In this ongoing series, we’ll provide real-world scenarios of the potential savings for solar, energy storage, electric vehicles and more. Today, we start with Uri’s story.

Uri works as an electrician in Chatham, New Jersey. While he considers himself to be a car buff, Uri has never really been convinced that an EV has the power and acceleration he wants. At least that was the case until he drove a friend’s EV and the acceleration really caught his attention. Uri has been shopping around for a new car for a few months but just hasn’t found the right fit. He’s now wondering if he should consider an EV.

Just as with every big life decision, Uri has some other things to factor into his car buying decision. For example, he has two children nearing college age, so Uri and his wife are focused on saving. Even though their household income brings in around $210,000 per year, he had always assumed EVs were too expensive. But with the new incentives just for electric vehicle owners in the Inflation Reduction Act, he thinks he might be able to qualify for up to $7,500 off the price of an EV.

That’s got him wondering…should the family go all-in by putting solar on their roof and an EV charger in the garage? He likes the idea of charging his car with clean energy. He’s heard that solar energy can help him lower his utility bills as well. And, his utility, recently said that they want to increase his electric rates. Right now, he’s already spending around $180 a month.

But how much would all of this cost? Even with all the incentives, Uri isn’t sure he can really afford any of this.

The Inflation Reduction Act offers EV owners financial benefits including up to $7,500 off the purchase of an EV and a 30% tax credit on the installation of home EV charging systems.*

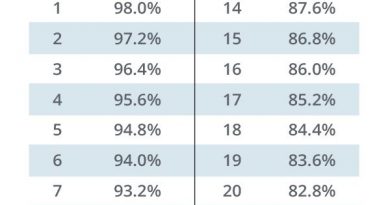

Uri has done some research and knows that to get the full EV tax credit of $7,500, the car he chooses has to be manufactured in North America with an MSRP under $55,000 for a sedan or $80,000 for a truck or SUV. Uri has his eye on a Chevy Silverado RST to carry all of his electrician tools. He was excited to discover that even if he adds a few bells and whistles to his purchase, he’ll still be able to stay well under that max.

Most homeowners find that powering an EV at home is much more convenient than public charging. In fact, 80% of electric vehicle owners choose to charge at home. Charging an EV can take hours, especially for large capacity vehicles like trucks. Uri could save himself a lot of time if he were to install a Level 2 EV charging system in his garage.

Uri has looked into home charging units a bit too and decides he likes the convenience of getting the well-reviewed Wallbox EV charger installed at the same time as a SunPower solar system. The two products really seem to make sense together since EV chargers typically increase a home’s power load.

With a rooftop system like a SunPower Equinox, Uri would be able to run his Chevy Silverado RST on pure sunshine versus relying on the rising prices and harmful pollutants caused by traditional fossil fuels. Through solar power and an EV charger, Uri and his family could offset much of their electricity and all of their gas bills while ensuring a measure of resilience during south Jersey’s increased frequency of major tropical storms. This idea gives Uri a level of peace of mind he hadn’t anticipated. He also likes the flexibility of leasing his solar system.

Now, let’s do the math. How much would the system cost vs. how much Uri can expect to save on energy costs and tax incentives?

Estimated costs

10.88 kW SunPower Equinox

WallBox: $1,600

Chevy Silverado RST: $52,974

Projected electricity offset from solar: $1,884 and after monthly lease payments of $132, an annual savings of $300. Without the ITC, the lease payments would be about $189/month.

Projected Annual savings on gas: $1,500

Estimated tax credits

Electric vehicle: $7,500

Wallbox: $1,120

Once he does the math, Uri decides it makes perfect sense to get started on a solar design while he finishes configuring his EV. Further, he learns that if he moves forward with leasing from SunPower, they will pass the savings from the Inflation Reduction Act onto him. Though he won’t receive the credit directly, the 30% solar tax credit will allow him to benefit from lower payments.

For more real-world examples of how to leverage the IRA for your own home energy needs, keep an eye out for new blog posts over the coming weeks.

Related posts

How Many Solar Panels Do You Need to Charge Your Electric Car?

Why Should You Get a SunPower Custom Quote?

* Tax credits subject to change. SunPower does not warrant, guarantee or otherwise advise its partners or customers about specific tax outcomes. Consult your tax advisor regarding the solar tax credit and how it applies to your specific circumstances. Please visit the dsireusa.org website for detailed solar policy information.

Original Source: https://us.sunpower.com/blog/2022/09/08/how-inflation-reduction-act-can-help-ev-drivers-save